Contents

Summary of Letter

In October 2023, Stephen M. Kohn — founding partner of Kohn, Kohn and Colapinto, Chairman of the National Whistleblower Center, and supervising attorney at International Whistleblower Partners — submitted a letter with formal recommendations to the Attorney General, Secretary of the Treasury, and FinCEN Director for the rulemaking process governing the Anti-Money Laundering Whistleblower Incentives and Protection Act (codified at 31 U.S.C. § 5323).

In this letter, Kohn argued that the new AML whistleblower regulations must not only replicate the existing SEC and CFTC Dodd-Frank rules, but should be built to align with the White House’s 2021 U.S. Strategy on Countering Corruption — a “whole-of-government” approach that designates anti-corruption as a national security interest and explicitly recognizes whistleblowers, civil society, investigative journalists, and foreign law enforcement as essential partners in that fight.

Because the Strategy did not exist when the SEC drafted its whistleblower rules in 2010–11, those earlier regulations were never designed to address the global, cross-border realities of money laundering and sanctions enforcement.

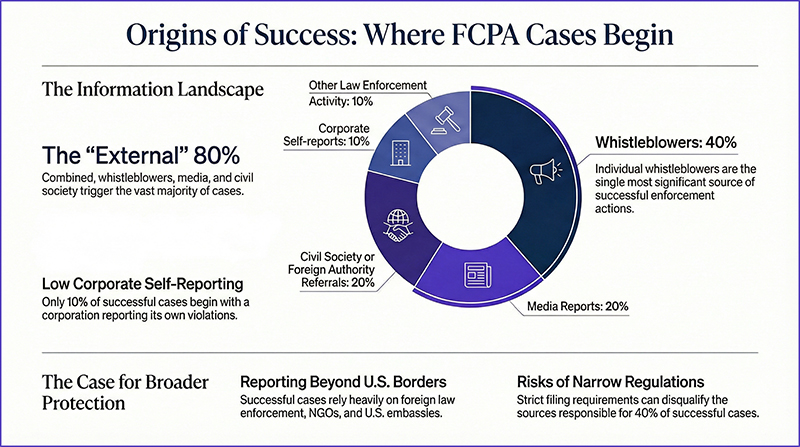

Where FCPA Cases Begin

Kohn references the OECD audit data to illustrate the gap between how whistleblower information reaches U.S. authorities and the limited channels recognized under current rules. According to DOJ statistics cited in the OECD’s Phase IV follow-up audit, successful FCPA cases break down roughly as follows: 20% from media reports, 20% from civil society or foreign authority referrals, 10% from corporate self-reports, and 10% from other law enforcement activity,40% originate from whistleblowers.

However, under existing SEC regulations, whistleblowers who report through many of these channels — foreign law enforcement, the news media, NGOs, U.S. embassies, or civil society organizations — risk disqualification from receiving a reward solely because they did not file directly with the appropriate U.S. regulator.

Final AML Recommendations

To address this concern, the letter included 15 specific recommendations for the final AML regulations. Among the most important:

- Broader definition of “voluntary” disclosure to cover reports made to foreign law enforcement, media, civil society organizations, U.S. embassies, and other first points of contact — not just direct filings with FinCEN or DOJ.

- Flexible filing requirements modeled on the Tax Court’s approach rather than the SEC’s narrow TCR process, acknowledging that international whistleblowers often cannot comply with highly technical U.S. filing processes.

- No mandatory internal reporting, mainly because employees at FDIC-insured institutions and credit unions lack protection from retaliation under the AML Act, and international whistleblowers have no safeguards under foreign law.

- No caps on awards, following the SEC’s own precedent from two rulemakings, and recognizing that large awards are critical to attract and incentivize future whistleblowers wherever they reside.

- Interagency coordination protocols to ensure that disclosures made to U.S. embassies, the State Department, USAID, FBI legal attachés, and foreign partner agencies are properly forwarded and credited.

- Eligibility for foreign government officials, rejecting the SEC’s blanket prohibition in favor of a more nuanced approach that accommodates anti-corruption committee members and employees of government-owned institutions.

- Timely award payments within one year, with front-line investigators documenting whistleblower contributions at the time a case file is closed.

- Protection against NDAs that interfere with an employee’s right to report concerns to the DOJ or FinCEN.

Kohn emphasized that whistleblowers who expose money laundering and sanctions violations often face harsh and potentially “life-threatening” retaliation, limited employment opportunities (blacklisted), and the need for police protection.

The regulations, he argued, must reflect the severity of these risks and create a program that genuinely incentivizes and protects individuals willing to come forward — especially those operating in dangerous environments outside of the U.S.

Report AML Violations

Are You an AML Whistleblower? If you are a whistleblower with information about money laundering, sanctions violations, or Bank Secrecy Act violations, experienced legal counsel can help you understand your rights, navigate the filing process, and maximize your protections. To learn more about the AML whistleblower program and how to report, get a free consultation today.

Joseph Orr

Joseph is an author at IWPA and writes about anti-corruption.