What is the Foreign Corrupt Practices Act (FCPA)?

Enacted in 1977, the Foreign Corrupt Practices Act (FCPA) is a groundbreaking U.S. federal anti-corruption law that prohibits the transaction of bribes to foreign government officials to obtain or retain business. To be considered an FCPA violation, corrupt payments must be made for the purpose of obtaining or retaining business. This has been interpreted broadly to include:

- Winning a contract or other government business

- Obtaining licenses, permits, or regulatory approvals

- Reducing customs duties or avoiding penalties

- Obtaining favorable tax treatment

- Gaining access to non-public information

- Securing an advantage over competitors

This is the first law of its kind established to fight international corruption, which plagues the global economy and can lead to serious consequences.

There are two types of provisions in the FCPA:

Anti-Bribery Provisions

These provisions make it unlawful for any U.S. person, company, or their agents to offer, pay, promise to pay, or authorize the payment of money or anything of value to a foreign official. The purposes of these payments include to influence any act or decision, induce an action in violation of lawful duty, secure any improper advantage, or compel a foreign official to use their influence to help obtain or retain business.

Accounting Provisions

The accounting provisions (also known as the books and records provisions) require companies with securities registered in the United States to: (a) make and keep books, records, and accounts that accurately and fairly reflect the transactions and dispositions of assets; and (b) devise and maintain a system of internal accounting controls sufficient to provide reasonable assurances that transactions are executed and recorded properly.

Quick Facts: FCPA Information Panel

| Foreign Corrupt Practices Act | |

|---|---|

| Short Title(s) | Domestic and Foreign Investment Improved Disclosure Act Securities Exchange Act of 1934 Amendment Unlawful Corporate Payments Act |

| Acronym | FCPA |

| Enacted By | 95th United States Congress |

| Effective Date | December 19, 1977 |

| Signed By | President Jimmy Carter |

| Introduced By | Senator William Proxmire (D-WI) |

| Public Law | Pub.L. 95-213 |

| Statutes at Large | 91 Stat. 1494 |

| Codification | 15 U.S.C. ch. 2B § 78a et seq. (Title 15: Commerce and Trade) |

| Enforcement Agencies | U.S. Department of Justice (DOJ) – Criminal Securities and Exchange Commission (SEC) – Civil |

| Major Amendments | 1988 – Omnibus Trade and Competitiveness Act 1998 – International Anti-Bribery Act |

| Related Whistleblower Programs | SEC Whistleblower Program ($2.2B+ awarded) CFTC Whistleblower Program ($395M+ awarded) DOJ Whistleblower Program (Pilot launched 2024) |

| Official Resources | DOJ/SEC FCPA Resource Guide FCPA Enforcement Actions |

Why the FCPA Matters

Foreign bribery distorts fair competition, diverts public resources away from essential services like healthcare and infrastructure, and can lead to dangerous outcomes when unqualified companies win contracts through corruption rather than merit.

The World Bank estimates over $1 trillion is paid in bribes globally each year — money that often comes at the expense of citizens in developing nations. Whistleblowers play a critical role in exposing these hidden schemes, protecting investors from undisclosed risks, and holding corrupt actors accountable.

Who does the FCPA apply to?

The FCPA is transnational in scope, which means it applies to foreign and domestic persons or entities involved in bribery.

- Within U.S.: this includes any U.S. citizen or corporation within the United States, as well as other entities such as partnerships, associations, joint ventures, business trusts, or unincorporated organizations where its main operations are within the U.S.

- Outside of U.S.: under certain circumstances, foreign nationals and companies can be held liable if they take any act in furtherance of a corrupt payment while in the territory of the United States or if they are agents, officers, directors, employees, or shareholders of a U.S. company.

Known as an issuer, any company that has securities registered with the Securities and Exchange Commission (SEC) and required to submit reports with the SEC is subject to both the anti-bribery and accounting provisions of the FCPA.

Intermediaries, consultants, distributors, joint venture partners, or third parties are also subject to the provisions. A company can be held liable for payments made by third parties if it knew or should have known that the payment would be passed on to a foreign official.

Understanding FCPA Further

Who is considered a ‘foreign official’ under the FCPA?

Foreign officials can be any officer or employee of a foreign government or department at all levels, from the head of state to an office clerk, and any person acting in “official capacity” for the government, agency, or for a public organization.

It can also mean any employee of a state-owned enterprise (SOE) or state-controlled company, which is common in countries where the government owns and controls major industries, such as oil and gas, mining, telecommunications, financial services, utilities, and healthcare, among others.

Also considered foreign officials are officers or employees of major public international organizations like the United Nations, World Bank, and other development banks. And any foreign political parties, officials or candidates for political office.

What is considered ‘anything of value” under the FCPA?

Cash is not the only type of bribe prohibited by the FCPA. The term anything of value refers to a broad range of payments, which include:

- Cash payments and cash equivalents, including wire transfers, checks, and money orders.

- Gifts, including luxury goods, jewelry, artwork, and collectibles.

- Travel and entertainment expenses, including first-class airfare, luxury hotel accommodation, expensive meals, and tickets to sporting events or concerts.

- Educational and employment benefits, such as scholarships, internships, or job offers for family members of foreign officials.

- Charitable donations are made at the request of a foreign official, particularly when made to organizations connected to the official.

- Business opportunities and favorable contract terms.

- Political contributions, including to political parties or campaigns connected to foreign officials.

There is no minimum exceptions under the FCPA — even small transactions can be a violation if made with the intent of gaining an advantage.

Legislative History of the FCPA

The FCPA was enacted in 1977 following revelations during the Watergate scandal and subsequent SEC investigations that more than 400 U.S. companies had made questionable or illegal payments to foreign government officials, politicians, and political parties. These payments totaled more than $300 million.

Key Legislative Milestones:

- January 18, 1977: Senator William Proxmire (D-WI) introduced the legislation in the Senate as S. 305.

- May 5, 1977: The Senate passed the bill.

- November 1, 1977: The House of Representatives passed the bill in lieu of H.R. 3815.

- December 6-7, 1977: The joint conference committee reached agreement, and both chambers approved the final version. The House approved the conference report by a vote of 349-0.

- December 19, 1977: President Jimmy Carter signed the FCPA into law.

Subsequent Amendments

1988 Amendments

Congress amended the FCPA through the Omnibus Trade and Competitiveness Act. These amendments clarified the business purpose test, added an exception for ‘facilitating payments’ for routine governmental actions, and created affirmative defenses for payments lawful under written local law and reasonable bona fide expenditures.

1998 Amendments

The International Anti-Bribery Act of 1998 implemented the OECD Anti-Bribery Convention, expanding the FCPA’s reach to cover foreign nationals and companies in certain circumstances and adding violations as predicate offenses under RICO and the money laundering statutes.

Examples of FCPA Violations

Bribes to Gain Business or Contracts

When people think of bribes, they are most generally thinking about payments to foreign officials to secure a contract, particularly in the industries and sectors the government controls, such as previously mentioned — oil and gas, mining, telecommunications, financial services, utilities, and healthcare, among others. Historically, companies have paid massive bribes to win such contracts, worth billions of dollars.

Take for example Goldman Sachs, who paid $2.9 billion to resolve charges related to the 1MDB scandal, where bribes facilitated bond offerings that were then looted by Malaysian officials (see the full case overview below).

Bribes to Obtain Approvals from Regulatory Bodies

In a similar fashion, a company may pay a bribe to obtain permits, licenses, or other approvals from regulatory bodies necessary to proceed with development or operations in the regulated industry or region.

For example, Alstom paid $772 million to resolve charges related to bribes paid in Indonesia, Saudi Arabia, and Egypt to secure approvals for power plant projects (see the full case overview below).

Political Contributions and Campaign Finance

Payments to foreign political parties, party officials, or candidates for office can violate the FCPA if made to influence government action or obtain business advantages. This includes both direct contributions and payments channeled through intermediaries.

For example, Siemens maintained slush funds that were used to pay bribes to government officials and political parties across multiple countries, resulting in an $800 million settlement (see the full case overview below).

Other less common examples include bribes to healthcare professionals at state-owned hospitals or payments to third-party consultants, agents or distributors who act as intermediaries with willful intent of facilitating a bribe. For example, Ericsson paid over $1 billion to resolve charges involving widespread bribery through slush funds and sham consultant contracts across multiple countries (see the full case overview below).

FCPA Enforcement and Penalties

The FCPA is jointly enforced by two U.S. government agencies: the Department of Justice (DOJ) and the Securities and Exchange Commission (SEC).

The DOJ can bring criminal charges against both companies and individuals, seeking criminal fines, imprisonment, and forfeiture of ill-gotten gains. The SEC can seek civil penalties, disgorgement of profits, prejudgment interest, and injunctive relief.

Penalties for FCPA Violations

In addition to other consequences like disgorgement, disbarment from government contracts, or license suspension, among others, the monetary penalties are:

Criminal Penalties for Anti-Bribery Violations:

- Corporations: Fines of up to $2 million per violation. Under the Alternative Fines Act, fines can be increased to twice the benefit the defendant sought to obtain.

- Individuals: Fines of up to $250,000 per violation and imprisonment of up to 5 years. Addtionally, fines can also be increased under the Alternative Fines Act.

Civil Penalties for Anti-Bribery Violations:

- Corporation or Individual: The SEC can impose civil penalties of up to $16,000 per violation. These amounts are adjusted periodically for inflation.

Criminal Penalties for Accounting Violations:

- Corporations: Fines of up to $25 million per violation.

- Individuals: Fines of up to $5 million and imprisonment of up to 20 years.

FCPA in 2024: Enforcement Statistics

In 2024, FCPA enforcement remained strong with the DOJ and SEC collectively bringing 38 enforcement actions, including 14 corporate cases and 24 individual prosecutions.

Key statistics include:

- Total penalties and fines exceeded $1.28 billion collected by U.S. authorities, making 2024 one of the top 10 highest grossing years in the FCPA’s history.

- Foreign governments and other U.S. agencies recovered an additional $400 million in related enforcement actions.

- The DOJ brought 9 corporate enforcement actions, collecting approximately $1.09 billion in penalties.

- At least 31 companies were undergoing FCPA investigation at the end of 2024.

For a more detailed report of these findings, please view the latest report:

https://fcpa.stanford.edu/enforcement-actions.html

Largest FCPA Enforcement Actions

Goldman Sachs and 1MDB Scandal (2020) – $2.9 Billion

Goldman Sachs agreed to pay more than $2.9 billion in penalties to resolve charges related to its role in the 1Malaysia Development Berhad (1MDB) scandal. The bank underwrote $6.5 billion in bond offerings for 1MDB, and investigations revealed that billions of dollars were illegally diverted into personal accounts of high-ranking Malaysian officials, including the then-Prime Minister. Goldman Sachs was found to have misled investors and facilitated the movement of stolen funds. This remains one of the largest FCPA settlements in history. (DOJ Press Release)

Ericsson (2019) – $1.06 Billion

Swedish telecommunications company Ericsson paid over $1 billion to resolve DOJ and SEC charges related to widespread bribery schemes across multiple countries including Djibouti, China, Vietnam, Indonesia, and Kuwait. The company admitted to paying millions of dollars in bribes over nearly two decades to government officials through slush funds, sham contracts, and off-books payments to secure telecommunications contracts. (DOJ Press Release)

MTS (2019) – $850 Million

Mobile TeleSystems, a Russian telecommunications company, agreed to pay $850 million to resolve FCPA charges related to bribery in Uzbekistan. MTS engaged in a scheme to pay bribes to obtain telecommunications licenses and frequency allocations in Uzbekistan, making illicit payments through intermediaries to government officials including an official closely connected to the daughter of the then-President of Uzbekistan. (DOJ Press Release)

Siemens (2008) – $800 Million

German conglomerate Siemens paid $800 million to the DOJ and SEC in what was then the largest FCPA settlement ever. The case involved systematic bribery across multiple business units and countries, with the company maintaining hundreds of millions of dollars in slush funds used to pay bribes to foreign officials around the world. The investigation revealed a corporate culture of corruption that had persisted for decades. (DOJ Press Release)

Alstom (2014) – $772 Million

French energy company Alstom paid $772 million to resolve FCPA charges related to bribes paid in Indonesia, Saudi Arabia, Egypt, and the Bahamas. Alstom used consultants and joint venture partners to funnel millions in bribes to government officials to secure contracts for power plants and other infrastructure projects. Several Alstom executives were also individually prosecuted. (DOJ Press Release)

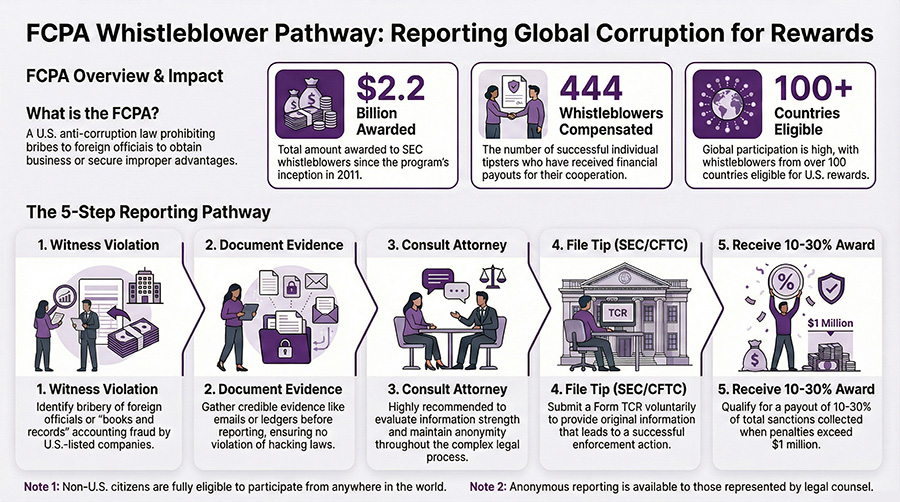

The SEC Whistleblower Program for FCPA Violations

The SEC Whistleblower Program provides a powerful incentive for individuals with knowledge of FCPA violations to report the information to the SEC and potentially receive a substantial financial award for that information and cooperation.

The program — including the ability to obtain an award — is open to international whistleblowers because most FCPA violations occur outside of the United States. Below are the key aspects of the program:

International Accessibility

Non-U.S. citizens and residents are fully eligible to participate in the SEC Whistleblower Program. Since 2011, over 2,000 non-U.S. citizens from more than 100 countries have filed confidential whistleblower reports with the SEC. Foreign nationals do not need to be in the United States to submit a tip or receive an award.

SEC Whistleblower Awards

Eligible whistleblowers can receive awards of 10% to 30% of monetary sanctions collected in successful enforcement actions where the sanctions exceed $1 million. Awards are paid from a dedicated Investor Protection Fund established by Congress and financed entirely through monetary sanctions paid by securities law violators. No money is taken from harmed investors to pay whistleblower awards.

Related Action Awards

Whistleblowers may also be eligible for awards based on sanctions collected in ‘related actions’ brought by other agencies or authorities, such as the DOJ, when the same original information led to both the SEC action and the related action. This is particularly relevant for FCPA cases, which frequently involve parallel criminal and civil enforcement.

Anti-Retaliation Protections

The SEC aggressively enforces anti-retaliation protections for whistleblowers. Employers are prohibited from retaliating against employees who report potential securities violations to the SEC. Whistleblowers who experience retaliation may be entitled to reinstatement, double back pay, and compensation for litigation costs and attorneys’ fees.

Anonymity Protections

Whistleblowers can submit tips anonymously, provided they are represented by an attorney. The SEC is required by law to protect the confidentiality of whistleblower identities and cannot disclose any information that could reasonably be expected to reveal a whistleblower’s identity, except in limited circumstances such as when disclosure is required by court order.

SEC Whistleblower Award Eligibility Requirements

To become eligible for an award, you must meet the following requirements:

- $1 Million Threshold: the monetary sanctions must total more than $1 million, which includes penalties, disgorgement, and interest collected.

- Original Information: You must submit information derived from independent knowledge NOT what is already publicly known.

- Voluntary Submission: The information being submitted must be done voluntarily, not because it was requested or demanded by the SEC or other regulator.

- Successful Enforcement Action: Your information must lead to a successful SEC enforcement action resulting in sanctions exceeding $1 million.

Information ‘leads to’ an enforcement action if the SEC initiates an investigation or examination based on your information, or if your information significantly contributes to the success of an existing investigation.

The SEC Whistleblower Program has become one of the most successful whistleblower programs in the world. Since inception in 2011, the SEC has awarded more than $2.2 billion to 444 individual whistleblowers.

SEC Whistleblower Program Statistics

| Metric | Value |

| Total Awards Since 2011 | $2.2+ billion |

| Individual Whistleblowers Awarded | 444 |

| Largest Single Award | ~$279 million (FY 2023) |

| FY 2024 Total Awards | $255+ million to 47 individuals |

| FY 2023 Total Awards | ~$600 million to 68 individuals |

| Countries Represented by Tipsters | 100+ |

How to Report FCPA Violations?

The steps to report an FCPA violation

Step 1: Gather Evidence

The SEC is looking to take enforcement action on strong and credible original information. Thus, it’s important to gather and preserve any documents, emails, communications, or other evidence that supports your allegations BEFORE you report.

Be careful not to remove confidential documents in violation of company policy or applicable law, such as through hacking. Preserve copies of materials you legitimately have access to. Make notes of what you witnessed, when, and who was involved.

Step 2: Consult with an Experienced Whistleblower Attorney

We cannot express this enough. If you have information regarding bribery or a violation of FCPA, engaging an attorney who specializes in FCPA whistleblower cases is highly recommended, as the laws and rules for whistleblowing are complex.

An attorney can help you evaluate the strength of your information, determine which agency or agencies to report to, prepare your submission to maximize the potential for an award, protect your identity through anonymous reporting, and advise you on your rights.

Step 3: File Your Tip with the Appropriate Agency

Those with original information can provide a tip without an attorney (not recommended) by submitting a Form TCR (Tip, Complaint, or Referral) through the SEC’s online portal at sec.gov/whistleblower. If you wish to report anonymously or a non-U.S. citizen, you must be represented by counsel.

Step 4: Cooperate with the Investigation

Award percentages (between 15% and 30%) can be determined by several factors. One of the factors that increase an award percentage is how cooperative an insider is during an investigation. Be prepared to provide additional information, clarify your original tip, participate in interviews, and testify if necessary.

Step 5: Apply for Your Award

If an enforcement action results in sanctions exceeding $1 million, the SEC will post a Notice of Covered Action. You then have 90 days to apply for an award using the appropriate forms (WB-APP).

Getting Expert FCPA Legal Assistance

It is highly recommended that insiders with information about foreign bribery seek an award obtain legal assistance right away to ensure the best possible outcomes.

International Whistleblower Advocates has over 35 years of experience, winning landmark cases under numerous whistleblower laws with transnational reach. Our team includes former SEC Commissioner Allison Herren Lee, former SEC Enforcement Counsel Andrew Feller, and Stephen M. Kohn, lead attorney on the cases above.

We represented Bradley Birkenfeld, whose disclosure of UBS’s Swiss tax evasion scheme led to a $780 million fine and a $104 million whistleblower award. We also represent Howard Wilkinson, who exposed Danske Bank’s $234 billion Russian money laundering operation involving Bank of America, J.P. Morgan, and Deutsche Bank.

If you’re seeking an FCPA whistleblower attorney, request a confidential case evaluation today — there is no fee unless we win your case and secure an award.